Urgence gaz 0 800 028 800

What are the perspects for biomethane in France in 2023 ?

The French biomethane market continues to boom, and remains one of the most dynamic in Europe. Its growth sits against a background of change: evolving rules and regulations, technological advances, increasing numbers of actors across the whole value chain, rising gas prices and biomethane costs, and not forgetting the climate emergency and geopolitical turmoil that regularly reshuffle the cards of the national strategy… An environment in which gas operators such as Teréga play a major role, supporting the development of a renewable gas industry that will be crucial to the future of the French energy landscape.

From biogas production to biomethane injection

Biogas production or biomethane production: what's the difference?

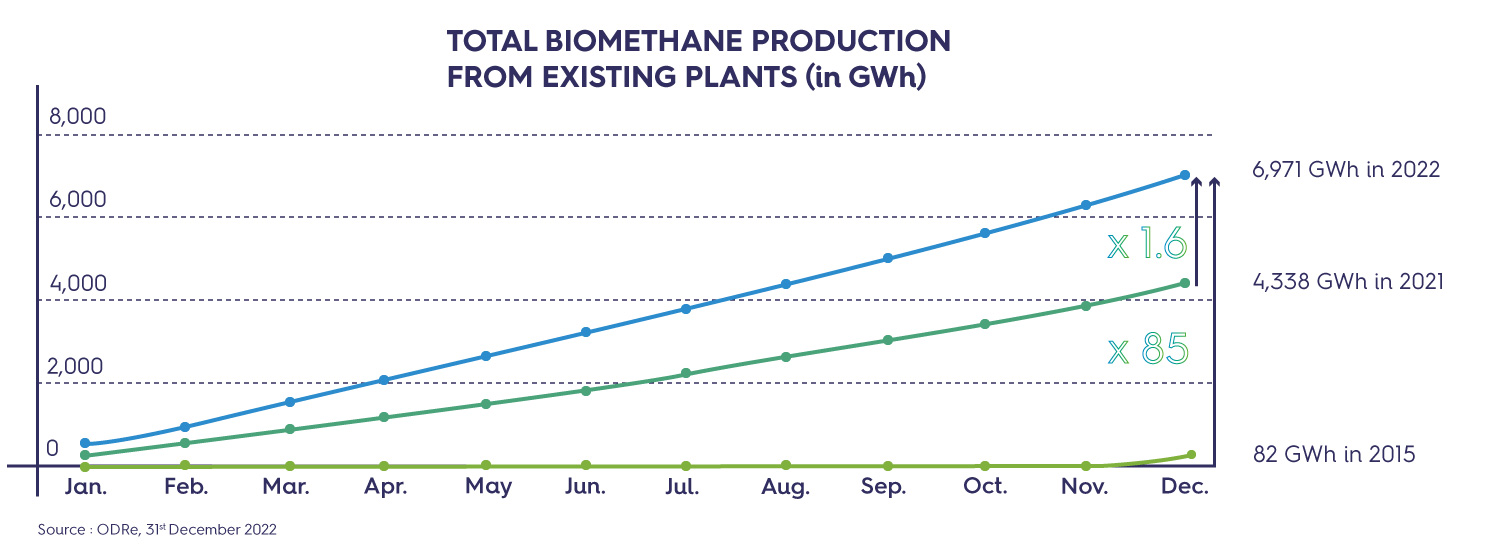

In 2011, France was in the process of commissioning its first site for the injection of biomethane into the gas grid. A movement was born.

Up until then, the biogas produced by the methanisation of fermentable organic matter (farm effluents, agricultural crop residues, municipal waste etc.) could only be used for the purposes of producing heat and electricity (cogeneration). But progress in purification methods has made injection into gas grids possible. In fact, once purified – meaning with the carbon dioxide separated out – the biogas which has now become biomethane can be odorised and then injected into gas pipelines.

The composition of biomethane is thus identical to that of natural gas, making it an ideal substitute for decarbonisation of the sectors that use that gas. It is a major lever for responding to the current challenges of climate change.

French targets for biomethane injection

This move to inject biomethane into the grid is part of the French political will to speed up the energy transition:

the Energy Transition for Green Growth Law (LTECV) set a target to increase the share of renewable gases in French natural gas consumption to 10% by 2030,

the Long Term Energy Schedule (PPE), now in force, sets an injection target of 7 to 10% biomethane by 2030,

the PPE also sets a target for biomethane injection of between 14 and 22 TWh by 2028.

Negotiations leading to the next PPE should start up again in 2023, deciding how those targets will change in the future. In the present context, the methanisation sector hopes to see them being raised considerably.

Survey of the biomethane sector in France in 2022

The renewable gas overview, prepared every year by Teréga, GRDF, NaTran, SPEGNN and the Renewable Energies Syndicate (SER) provides a full survey of the booming renewable gas sector.

The seventh edition, published in February 2023, presents the most recent data on how the French biomethane market is changing.

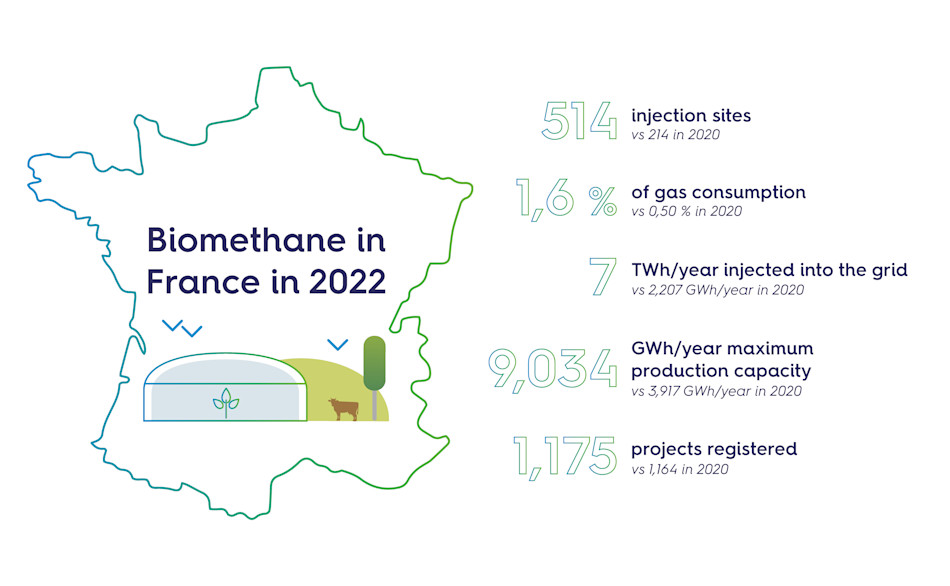

On 31st December 2022, France had 1705 biogas production units. They included 514 units (i.e. 30%) repurposing it in the form biomethane for injection into the grid, compared with 214 at the end of 2020. “This figure underlines the industry’s incredible dynamism,” comments Lionel Lalanne, manager of the territorial development department. “300 sites created in two years. That’s a considerable acceleration in bringing these units online. Not only do we have an enormous number of projects on the table, but on top of that, the industry has been in a position to industrialise them.”

Biomethane in France in 2022

This dynamism does however risk flattening out over the coming years, as a large proportion of the projects which have been launched are now built, particularly in the agricultural sector. The process of bringing new projects to light will require a number of technical, economic and regulatory stages to be gone through, which will all take time. At the moment, it takes an average of three years from the start of a connection feasibility study for a methanisation unit to the site’s commissioning. “Since 2011, the emergence and development of the industry have relied on the regulated tariff put in place by the State and guaranteed for 15 years,” continues Lionel Lalanne. “In November 2020, the conditions for accessing that tariff were made tougher, which had the effect of holding new projects back. We therefore expect to see a drop-off in commissionings from the end of 2023 and start of 2024, and that could last several years. But the industry is already looking at ways of restoring its dynamism.”

New tools to speed up biomethane markets

From state intervention to the promotion of free trade, several levers for growth can be implemented:

Reindexation of the regulated purchase tariff to account for inflation:

Announced at the end of 2022 by the Minister for Energy Transition, the change in the tariff also considers the hourly cost of labour and the production price index.

Support for biomethane production by invitations to tender:

At the end of 2022, public stakeholders decided to launch calls for tender for biogas production. The first tranche was for 500 GWh, at a price judged by producers to be too low. A new round of invitations to tender is currently being launched.

Biogas production certificates:

The State wants to put French energy suppliers under an obligation to supply a proportion of their portfolio of customers with biomethane. Whether they produce it themselves or buy it from third party producers, that biomethane will give them certificates to prove they are honouring their obligations. This arrangement, which is still being negotiated, will help share out the work of developing the industry across the State, producers and energy suppliers.

BPA (Biomethane Purchase Agreement) :

These over-the-counter contracts will soon be negotiable directly and freely between a biomethane producer and a consumer. This simplification of the transaction process is meant to speed up the development of a virtuous local ecosystem.

The role of gas operators in the development of biomethane and challenges for the future

“The first role for gas operators such as Teréga is to guarantee the right to inject for any biomethane producer located near to a network,” explains Lionel Lalanne. Once certain technical and economic conditions have been met, operators must make the necessary arrangements to allow access to their infrastructures. We must be facilitators of the accommodation of endemic production on our grid.”

Teréga, with the support of all gas operators located close to production premises, carries out connection zoning: this jointly-run futurology exercise makes it possible to determine the optimal way of welcoming all producers onto the grid who want to inject their biomethane over the coming years.

The subtle technical and economic balance found as a result of the process is aimed at creating the best possible conditions for developing the grid at the lowest possible cost. Once the mapping is decided upon, operators will be able to consult the Energy Regulation Commission and stakeholders wanting to have a stake in those projects, and then get the investment funding released, build, operate and maintain the new plants.

“This process is part of our public service mission as an operator,” stresses Lionel Lalanne, “namely, ensuring continuity of accommodation on the grid, in just the same way as we ensure continuity of supply.” Thus we’re supporting the creation of energy and jobs in local virtuous circles, at the same time as guaranteeing the sustainability of our own business. We’re also helping strengthen the nation’s energy sovereignty. In France, 7 TWh of

biomethane was injected in 2022, representing 10% of former imports of Russian gas. And while, over the whole year, those 7 TWh covered only 2% of consumption, we saw peak levels last August of 10% green gas flowing through the grid in the South West.” .